Global Markets

US Yield Curve

Fed Rate Monitor

Crypto Spot Market Cap

Fear and Greed Index Chart

Altcoin Season Index

CoinMarketCap 100 Index

Crypto ETF Net Flows

Key Technicals

Market Commentary

FX markets haven't really

moved significantly last 2 weeks which can be seen in USD index being stagnant.

However $/MXN and $/CAD has volatile swing thanks to Trump coming to power only

to reach stronger levels due to merry-go-round of threat, counter threat and

deferrals. Despite deadline for 10% tariff on China and China’s instant

retaliation for 15% import tax on US goods, the $/CNY remains well offered.

This indicates that markets expect Trump to make a lot of noise / fake

posturing but ultimately reach mutual concessions which wont derail global

growth. Weighting of CNH, MXN, CAD in the Fed’s broad trade-weighted dollar

index amount to 41% and if you add EUR into the mix the contributes jumps to

+60% so we can see where this is clearly going.

Vietnam’s trade surplus with

the US hits record high in 2024 and only SEA nation behind only China, EU and

Mexico in the scale of its trade imbalance with Washington. Analyst says

Hanoi’s pledges to import more from the US as well as other offsetting measures

could spare it from punitive measures. Interestingly, Trump has been silent

about Vietnam despite her being a major beneficiary of the last US-China Trade

War. Despite the ballooning trade gap, Vietnam is in a different position from

on the top exporters as it does not pose an apparent security threat to the US.

Vietnamese officials have repeatedly said they would seek to find compromises

with Washington on trade. Among possible sweeteners are boosting Vietnam’s

imports from the US of LNG and reduction of import duties on US agricultural

products such as soybeans, cottons and meat. It has been noted that exports

were hard to cut as they were mostly from large MNC operating from Vietnam such

as Samsung Electronics and Intel.

According to a poll conducted

from 3rd – 5th Feb involving 35 FX analysts, the CAD is

expected to weaken to 1.44 in the next 3M. Since Oct 2024, the loonie has

weakened by 5& due to trade uncertainties and widening interest rate gap

leading to a 1.6% drop in 2Y Canadian note yield compared to its US counterpart,

the most significant disparity since Sep 1997. On 06/02, the rupee hit an ATL

amid trade policy woes and continued portfolio outflows. Market sentiment has

been bearish with short bets on rupee climbing on their higher levels since Jul

2022 even as outlook on other regional currencies have been less negative.

Corporate treasurers are

intensifying their efforts to protect company earnings from possibility of

prolonged USD strength. Speculative investors have significantly increased

their bullish positions on the dollar with net long dollar bets reaching $35B,

a level not seen in nearly 9 yrs. Apple has warned that the stronger USD could

reduce its current-quarter revenue by 2.5% y/y. Similarly, Johnson &

Johnson cited that unfavorable currency movements could decrease its 2024

sales by $1.7B and Microsoft has said that 3Q revenue growth could be impacted

by 2%. Smaller companies which have less sophisticated FX operations and limited

hedging budgets are particularly challenged by the strong USD.

Equity indices also lacklustre with exception of HSI and HSCEI moving up 9.2% and 10.9% respectively and despite Trump’s moves S&P 500 is stick within 6000 – 6100 range. Did notice that Fed rate cut expectations have halted to zero as far out as 2 Fed meetings since Trump took power except for a 47.8% probability of another 25 bps cut in Jun 2025. This takes away policy support for US equity valuations and on 23/01, US jobless claims at 223k remains low weakening the case for further rate cuts. Style-wise only USMV has gained 3% which makes sense given Trump induced market volatility. Still waiting for the key 6200 to be breached on S&P 500 and will continue to watch closely.

However, did noticed flag breakout on MSCI Asia Pacific ex Japan is following through nicely since 07/02. This is a good time for those of you looking to enter or top up existing Asian equity positions. The index is well unvalued if compared to S&P 500 and MSCI Europe which have enjoyed a strong bull run since last year.

Ukraine War however is coming to an end as Trump is clearly throwing Zelensky under the bus calling him a dictator and excluding him from that Saudi Arabia meeting with Putin. On 21/02, Zelensky declined an initial proposal by US Treasury Secretary Scott Bessent, the US is now strong arming Ukraine for 50% of their mineral resources by raising the possibility of cutting the country’s access to Elon Musk’s vital Starlink satellite internet system. Atlantic Council Melinda Haring said losing Starlink would be a game changer noting that Ukraine now at 1:1 parity with Russia in terms of drone usage and artillery shells.

On 04/02, BofA says Feb month tends to be weak for SPX 500 particularly during 1st year of a presidential cycle but noted that market conditions tend to improve in the following months. 25D $/INR risk reversals have increased which indicate that cost of option betting against the rupee has gone up compared to those betting on its appreciation.

This is despite Nvidia tumbling 17% or $589B in market-cap after DeepSeek made its debut. What sets Deepseek apart is efficiency as its model was trained using just $6M worth of computing power using Nvidia H800 chips which at that time complied with US export controls. The release and testing of Deepseek R1 sparked questions over a surge in spending on building out AI infrastructure by major US tech companies. Alibaba also revealed its new AI model on 03/02 which it claims outperforms leading AI system such DeepSeek-V3, OpenAI’s GPT-4o and Meta’s Llama-3.1 in various benchmark tests. This demonstrates that Chinese companies since Trade War 2018 have been able to outthink the US authorities and avoid them getting trapped in their rigged geopolitical games. Also, Elon Musk on 18/02 announced Grok-3, the latest iteration of its chatbot as it looks to compete with DeepSeek. However, D.A. Davidson Luria commented that improvement over Grok-2 model appear too small to justify the enormous resources reqruied to train it. This show US is chasing China now in the AI arms race and also demonstrates that Elon much more useful than Jared Kushner and Ivanka Trump. Both of them were very prominent during Trump’s 1st term but not loyal during his many investigations despite blood ties. Also, they didn’t bring much to the table either despite getting a seat which explains why they have magically disappeared in Trump’s 2nd term.

On 02/02, OpenAI also unveiled a new mode for ChatGPT which let’s the chatbot perform complex, multi-step research on the Internet. They state that “we think it is important for our models to start doping autonomous task for much longer in an unsupervised way” towards their ultimate goal of delivered artifical general intelligence. This would be a hypothetical AI that can learn and understand any intellectual task as the same capacity as a human.

Interestingly, DeepSeek has actually been a key factor in offseeting concerns realted to ongoing trade tensions between US and China. This has lead to Asian stocks rising on this AI optimism particularly chipmakers such as TSMC, Samsung, SK Hynics, Foxconn and Advantest Corp. On 10/02, Baidu, Xiaomi, Alibaba, Tencent and JD.com all jumped 2 – 6% intraday. Great Wall Motors has in fact integrated DeepSeek’s AI into its “Coffee Intelligence” vehicle system whilst major telecom providers are collaborating with their open-source model to enhance their services.

Trump again blamed Fed Powell for creating an inflation problem they have failed to resolve which he intends to address by stimulating US energy production, cutting regulation, adjusting international trade balances and boosting American manufacturing. On 03/02, he said UK might be able to dodge the tariff which sounds like a backdoor deal is being done. UK must being doing something for US as its unlikely to be getting a freebie like above as EU not enjoying such privileges. On 22/02, Trump met with Australian Treasurer Jim Chalmers and also considered exempting Australia from his steel and aluminum tariffs in view of their trade surplus. However, its clear that key allies UK and Australia are being treated very differently from lesser allies and they don’t need to give any concessions whatsoever so far.

On 03/02, Trump suspended his threat of steep tariffs on Mexico and Canada in return for concessions on border and crime enforcement with the two neighboring countries. He also threatened to raise the 10% tariffs on China even higher until fentanyl stops being sent. Doesn’t seems to be US policy to arrest, jail and execute the American consumers who are actually creating the demand for the drug.

On 10/02, Trump also

announced 25% steel and aluminum tariffs followed by reciprocal tariffs on many

countries with both duties to be effective immediately. Canada, Brazil, Mexico,

South Korea and Vietnam are the biggest exporter of steel to the US. In

particular, Canada is the biggest exporter of aluminum to the US. He also told

Air Force One reporters the White House is investigating US Treasury debt

payments for potential fraud and posited that America’s $36.2T debt pile might

not be that big. The comments come as Trump and fellow Republican members in

Congress may face the task of approving more borrowing sometime this year. On

10/02, Brazil denied a report stating the country was planning to impose tax on

US tech companies in retaliation to Trump’s steel tariffs.

Trump also been pressuring

NATO allies to raise defense spending to 5% GDP which is a target none of the

32 NATO member states including the US doesn’t meet. Mark Rubio also commented

that “its interesting and in fairness Poland, Lithuania and Estonia, the closer

you are to Russia, the more they are spending as a percentage of GDP on

national defense but you have big, powerful economies and they don’t spend as

much on national security”.

In response to Trump tariffs.

Spanish Economy Minister Carlos Cuerpo emphasized the need for unity within the

EU and not to be naïve and ensure its companies are able to compete equally

with international clients. Trump has also asked Zelensky for security for

Ukraine’s assets such as rare earth minerals and wants “an equal amount of

something” in exchange for US support.

Even India in Trump’s

crosshairs as his top economic advisor Kevin Hassett said on 02/10 that India

has high tariffs that lock out imports adding that Modi has a lot to discuss

with Trump when two leaders meet soon. Key issues would be India’s plan to

propose increasing energy product imports from the US estimated at +$11B in

first 11 months of 2024 to alleviate trade imbalances. As the world’s 4th

largest LNG importer, India may push its oil companies to purchase more US LNG

buoyed by Trump’s lifting of export permit bans for new projects. Indian will

also likely negotiate the purchase and co-production of combat vehicles and

finalize a fighter jet engine deal. Protracted talks have been ongoing between

India and US over co-production of General Dynamics’ Stryker combat vehicles. Officials

from Hindustan Aeronautics Ltd are set to meet with US officials and GE Aerospace in the coming weeks. They

are also scheduled to discuss the deportation of illegal Indian immigrants by

US and India’s concern about their treatment. USISPF President Mukesh Agi said

the industry is addressing the misuse of H1-B visas whilst seeking an increase

in legal migration to meet US’ professional shortage. Elon Musk also due to

discuss with Modi to bring Tesla to India and expedite the allocation of the

satellite spectrum for his Starklink project.

Also, Trump has cut funding

to South Africa over its expropriation act no doubt egged on by Elon Musk who

comes from that part of the world. US has obligated nearly $440M in assistance

to South Africa in 2023 and last month President Ramaphosa signed into a law a

bill that would make it easier for the state to expropriate land in the public

interest. This shows that Elon Musk is willing to use his political position to

push his own agenda not just in the US but internationally as well.

On 03/02, Capital Economist

predicts the “resulting surge” in price gains in the US from the tariffs and

“other future measures” could come “even faster and larger” than they initially

anticipated. Under those circumstances, the window for the Fed to resume

cutting interest at any point over the next 12 – 18M just slammed shut.

Noticed CSI 300 line of

polarity hasn’t been breached which is a very good sign from a technical

standpoint. Also, DMI and MACD crossover have happened. Now is a good time to

enter or top up Chinese equity exposure for those of you on the sidelines or

taking the drawdowns since 2015. On

17/02, Michael Burry reduced his positions in Chinese technology stocks shortly

before a significant market surge driven by DeepSeek’s AI breakthrough according

to 13F filings. This includes reducing his JD.com stake by 40% in 4Q24 whilst

Alibaba was trimmed by 25%. Coincidentally, Alibaba is being decumulated by

institutional investors like Burry since Nov 2024 particularly during 20/02

surge to $136. This is unlike the CSI 300 which doesn’t have such volume action

so it would suggest the institutional investors have lost their patience as

Alibaba laggard in every China equity fund last +4 years. Alternatively, they

might have insider information but whilst institutional investors tend to hold

the edge they get it very wrong at certain times due to group think,

performance pressure, etc. Otherwise all those China equity funds would not

have lost money in the Chinese market. Interestingly, we also see these same

institutional investors steadily accumulating Tencent shares in the same time

period.

On 16/02, China’s XJP held a

rare meeting with business leaders including estranged leader Jack Ma urging to

“show their talent” and be confident in the power of China’s model and market. Gavekal

Dragonomics Christopher Beddor stated that it’s a tacit acknowledgement that

the Chinese govt needs private-sector firms for its tech rivalry with the US.

Huawei’s Ren Zhengfei and HYD’s Wang Chuanfu sat directly in front of XJP,

seats of honour for national champion in EV and chip development. Deepseek

Liang Wenfeng also attended the meeting. Baidu Robin / Eric were missing from

this important meeting which led to $2.4B being wiped off Baidu’s market cap. Broker’s

said Baidu’s ahres have bene weak since the morning it said it would connect

its search engine to DeepSeek and its proprietary Ernie large language model.

On 10/02, China Premier Li

Qiang also said on CCTV that China will boost residents’ income to support

consumer spending. In Jan 2025, China added more home appliances to a list of

product that can be used in its consumer trade-in scheme and will offer

subsidies for additional digital good to revive demand in the sluggish household

sector. Chines leaders have pledged to vigorously boost consumption this year

as they seek to stimulate domestic demand and offset and anticipated decline in

exports – a key growth driver.

Traders in China’s

manufacturing hub of Yiwu shrugged off Trump’s tariff and moves against China

on 09/02 saying they have made preparations to soften the blow. Yiwu city in

Zhejiang province is the world’s largest wholesale hub for small manufactured

items, exporting product ranging from Xmas trees to consume jewellery globally

including the USA. Beisi Group Chairman Cheng Haodong said that Trump’s

campaign promised 60% tariffs on Chinese imports before he was elected.

However, he revised that to 10% after taking office and plans to cancel

duty-free treatment of low-cost packages from China. Beisi export to other

businesses abroad, but also sells some of its product directly to US consumers

through online platforms Temu and Shein, low-priced shopping sites that analyst

will be hard hit by Trump’s repeal of the “de minimis” a trade loophole that

allowed low-value imports to enter the country duty-free.

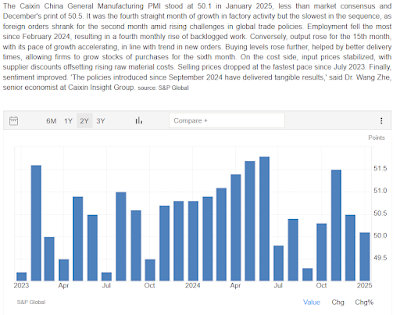

Chinese manufacturing PMI

grew 50.1 which continues to be on a decline. The private survey stated that

sentiment improved among Chinese

manufacturers at the start of 2025 on expectations of supportive govt policies

nonwithstanding US tariff threats. Taiwan Lai Ching-te said that Taiwan and

China need to talk to each other to achieve peace given “multifold changes” in

the international situation. This conciliatory tone sounds like Taiwan has

observed the Ukraine being slowly abandoned by USA and being more practical

about their sovereignty. On 01/02, Moody stated that India’s decision on

Saturday to ease the tax burden for the middle-class consumers may not have a large

impact on growth.

German opposition leader

Friedrich Merz tipped to be the next chancellor said on 23/01 that he plans to

win back lost trust of key allies and ensure Berlin more assertive on the

global stage. Germany’s partner have struggled to cooperate with Berlin due to

infighting driven by Chancellor Olaf awkward three-way coalition. That discord

led to the coalition collapse late last year, prompting a snap election on

23/01 that Merz is on track to win. Unsurprisingly, Merz has also promised to no

longer restrict weapons deliveries to Israel. However he did urge US and EU to

agree on a free trade deal rather than fall into a tariff spiral as many fear

with Trump’s American First agenda. He also down played remarks that US needed

to take control of Greenland from Denmark.

Fixed income markets also

calm except for 2Y JGB and 10Y JGB which have jumped 17.1% and 16.7%

respectively. Interestingly, 2Y and 10Y German bunds have dropped 6.6% and 2.2%

which is normally well correlated to sovereign yields. REITs surprisingly more

action packed that risk assets with CDLT -6.4% and UOAR -6.8% whilst SUNW

jumping 3.2%. Yields for S-REIT between 5.7 – 6.8% actually quite decent

considering interest rate outlook.

Commodities markets also

quiet except for XAU/$ and XAG% moving higher by 5.78% and 6.1% respectively.

NG futures fell 14.1% during the same period. Gold bulls in particular are

locked on to $3000 milestone as Trump has ignited more safe-haven flows. ANZ

Bank Daniel Hynes commented that “Gold in the BOE value is trading at a

discount to the wider market. This has seen week-long queues to withdraw the

metal”. Gold bullion banks are flying gold into the US from trading hubs

catering to Asian consumers including Dubai and HK to capitalize on unusually

high premiums. Gold in COMEX-approved warehouses stood at 34.6M ounces, a more

than 90% rise since Nov 2024 and their highest level since Jun 2022. On 09/02,

Malaysia’s CPOB said that palm oil output resilient despite flood disruption.

Trump’s plan to broker a

peace between Russia and Ukraine has huge implications for the global commodity

markets. The key expectation set to unveiled at the Munich Security Conference

resolves around easing hostilities and potentially reopening Russian energy

flows into Europe. Before the war, Russia accounted for approximately 30% of

Europe’s gas supply which has since dwindled to zero. Should Russian pipplines

flows through Ukraine resume at even modest levels, European storage levels

would improve and gas prices will likely decline further relative to coal.

Goldmans Sach analysts also note that an easing of Western sanctions on Russian

oil will not lead to a supply surge as global production remains tightly

managed by OPEC+ rather than by sanctions alone. The existing G7 oil embargo and

price cap on Russian crude have been effective in redirecting Russian oil

exports from Europe to alternative markets such as India and China.

GS analysts suggest that if

Russian natural gas supply to Europea is restored, it could drive down European

natrual gas prices by 15 – 50%. If Reussian supply returns to pre-war levels,

the prices of TTF could drop to mid-20s EUR/MWh.

Crypto taken a pullback with

ETH/$, SOL/$ and XRP/$ dropping 18 – 31% range. Unsurprisingly memecoin SHIB/$

and DOGE/$ plummeted 22.7% and 30.6%

respectively. Finally VIX index has popped 23.2% on Trump induced volatility. Traders

seems indifferent between BTC and altcoins at 38 level on the Altcoin Season

Index Chart. Crypto ETFs flows seem to be drying up in Feb 2025 with net

outflow $585B on 10/02 versus inflows of $2.9B in 02/12.

Blackrock is planning to

introduce a new exchange-traded product in Europe that is directly linked to

BTC. This move comes after the successful launch of its $58B crypto-tracking

ETF in the US. Interestingly, Standard Chartered Bank see a clear pathway for

BTC to reach $500k driven by growing investor access and declining volatility.

The approval of spot-Bitcoin ETF in Jan 2024 unlocked pent-up demand drawing net

inflows of $39B so far. The repeal of SAB 121, a regulatory hurdle that

previously required companies holding digital assets for customers to recognize

them as liabilities is seen as a key step forward. Furthermore, Trump 23rd

Jan order to evaluate potential national digital assets stockpile could prompt

central banks to consider Bitcoin investments. The Crypto Fear & Greed

Index which measures market sentiment for Bitcoin and other crypto has remained

in fear in with an average score of 44 /100 on 10/02.

Former Binance CEO CZ has

raised concerns over crypto exchange’s token lisitng process which he believes

may be flawed due to the short notice before new tokens are listed. Zhao

pointed out that the typical 4-hour window between a token’s announcement and

its listing could lead to significant price volatility on decentralized

exchanges. He noticed that when Binance annocunes a new token listing, prices

tend to spike on decentralized exchanges, followed by selloff on centralized

exchanges. The issue came to the fore with the unexpected popularity of TST, a memecoin

that featrued in a BNB Chain video tutorial about launching memecoins through

Four.Meme platform. The coin’s exposure was further amplified by Zhao’s

subsequent social media post the week before, which was intended to clarify he

did not endorse TST but ironically resulted in increased attention for the

token

Compass Point Research has

forecasted BTC/$ to reach $160k by the end-2025. Whilst bitcoin has yet to

reach peak market euphoria, analyst suggest the cycle is in its “7th

inning” with institutional demand expected to be the dominant force in BTC’s

next growth phase.

No comments:

Post a Comment