Global Markets

Crypto Dominance

US Yield Curve

Fed Rate Monitor

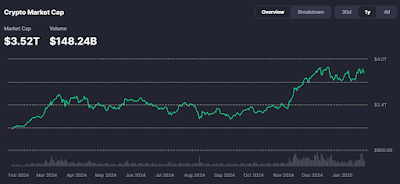

Crypto Spot Market Cap

Key Technicals

Market Commentary

FX markets been relatively calm except for $/IDR surging 22% since Nov 2024. Other than that, it’s been mainly been USD strength against other currencies despite pulling back of interest rate cut expectations. Given most other countries they aren’t on the rate hiking path hence the USD momentum remains in play. Commodity currencies AUD/$ and NZD/$ have had the more significant moves with -3.7% and -4.3% respectively.

During this period, the EUR/$ fell further hitting recent low 1.0300 with Moneycorp Eugene quipping that “every country or multie-country union that is facing any potential threat in tariffs really having a hard time against the dollar”. On 16/12, BofA stated it expects $/JPY to overshoot due to Fed and BoJ opposing monetary policies with risk of correction in 1Q25. UK home prices growth rate have rebounded to 3.7% in Nov 2024 which extends the acceleration last 2Y. These house prices have outpaced average income and interest rates and exceeded even pre-Covid level which is pretty inflationary.

On 14/11, Japan’s economy expanded 0.9% for 3Q24 which highlights its frailty toward US slowdown or further Chinese export weakness. Taking a step back however, we have seen a turnaround as the Japanese economy bottomed out in 1Q24 from a 0.7% contraction. Stronger than expected private consumption supports the BoJ’s forecast for further economic recovery driven by higher wages and consumption helping inflation sustainably hit its 2% target thereby justifying higher rates. So far, that inflation rate actually been pretty comfotably above 2% target since Apr 2022. $/CHF rose in Dec 2024 after surprise SNB rate cut whilst $/BRL did the same triggered by market disappointment over a much-anticipated govt spending cut package.

On 26/11, most Asian currencies including CNY dropped to 4M low against the greenback due to tariff threats. Trump has said he will impose a 25% tariff from Mexico to Canada and an additional 10% on Chinese goods to hit 60% citing drugs and migrant issues. However, the move would violate a free-trade deal between US and the former countries. On 14/11, Malaysia’s economy slowed in 3Q24 after peaking in prior quarter at 18M high due to drop in oil and gas output offsetting a surge in investment activity and resilient household spending.

MSCI World slightly positive since Nov 2024 at 3838 whilst SPX has moved above last ATH 6100 overnight. Last 3M, the SPX has dipped below 5800 since then to hit recent low 5775 on 13/01 which stoke fear and uncertainty. It initially appeared to be making another downleg on 13/01 only to transform into a flag pattern breakout on 17/01. The flag pattern formed due to dampening investor enthusiasm after Trump victory on 11/12 due to inflation and tariff, tax cut and immigration concerns. This breakout is a good opportunity to ride up the rally and exit more US equity exposure at 6200 and 6700 depending on sentiment / liquidity factors.

Sector-wise the small-caps have endured the most pullback with IJR retreating 4.3%. Value and low volatility also lagging with IUSV and USMV dropping 2.8% and 2.6% respectively. Surprisingly, growth stocks have actually been resilient with IUSG +5.2% during the same period suggesting that investors still have risk appetite despite stretched US equity valautions.

European stock indices up 6.6 – 10.2% which only happened in the last few weeks which is pretty significant given that MSCI Asia Pac Index has dropped 5.7%. Within that, Chinese stocks have really taken a leg down with CSI 300 and Shanghai Comp falling 5.1% and 8.7% respectively. Having said that that the CSI 300 might be forming a 14Y ascending flag pattern with a recent pennant breakout. The breakout is weak though and right now is testing the line of polarity so need to watch closely. Rest of global stocks were lacklustre with only MICEX rising 6.7%.

Fed cut 25bps in Dec 2024 within expectations with sticky inflation doubts messing with further rate cut expectations for 2025. Will be interesting to see if Trump follows through with his prosecution threats on Kamala, Biden, former intelligence officials, prosecutors, tech moguls and left-wing Americans. Last time, he made the same threats to Hillary but backed off as it would “look terrible”. Interestingly, Mark Zuckerberg which was also threatened did say Trump’s reaction to the 13/07 assasination attempt was “one of the most badass things I’ve ever seen in my life”. Seems he is swallowing his pride to get back into the Trump’s good graces given Elon’s recent moves.

Also, both Elon Musk and Vivek Ramaswamy will lead Department of Government Efficiency (DOGE) with mandate to cut down excessive regulations, streamline bureacracy and reshape federal agencies. In true Trump style, a key deadline of 4th Jul 2026 has been set like his USD-Mexico wall which was really a extension of the existing border fence system. Also, Elon political ascendancy has some Wall Street Banks hoping they may soon be able to offload $13B debt that backed his purchase of the social media X platform. Typically such loans are sold to investors after the deal but in this Elon’s case they have been holding the bag since 2022. Elon’s sweeping changes have scared away advertisers and hit reveues which in turn has reduced the value of debt as default risks have increased. Also, turns out Elon spent more than $250M to help elect Trump rather than Biden and now its paying off. Even his SEC investigation into alleged securities violations during his $44B Twitter takeover in 2022 are being stymied.

On 11/12, Fed Kashkari stated

that US monetary policy is “moderately restrictive” with short-term borrowing

costs continuing to slow inflation and the economy. Fed Barkin added that the

Fed is ready to respond if inflation pressures rise or the job market weakens

which is basically hedge talk. Fed

Musalem also talking the same message. Interestingly, Fed Austan signaled on

15/11 that the Fed will likely end up cutting policy rate by another 125 bps by

end-2025. This is in stark contrast to Morgan Stanley on 19/12 which only

expect 3 rate cuts spefically in Mar and Jun 2025 amid sticky inflation. Even

more intruiging is that despite Fed rate cuts, 30Y mortgage rates have risen to

7% in tandem with US Treasury yields which shows Fed doesn’t have any influence

on the long-end of the curve.

On 13/12, Fed Chair Powell said officials will also “patiently” consider bring rates down further to a “neutral” setting that neither helps nor hinders economic activity. However on that day, the SPX pulled back and Dec rate cut bets fell from 8% to 60% which prove further insight that what Fed Chair Powell says matter more to the market than Fed Barkin, Musalem or Kashkari.

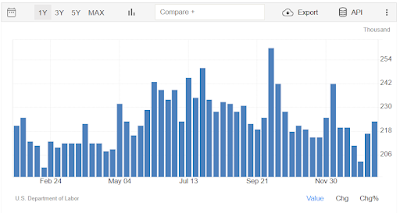

NFP payroll at 227k in Dec 2024 has been consistently strong surpassing forecast 202k and well above prior month 36k number. Also, ISM Manufacturing PMI at 49.3 in Dec has picked up for the 3rd consecutive month which demonstrates resilience and economic growth in US manufacturing despite headwinds. On 23/01, the US labor market continues to tighten since Sep 2024 with 223k print.

Banks such as UBS are still bullish on technology, utilities and financials with projections that SPX will reach 6600 by end-2025 despite assigning 35% probability of a stock market bubble. GS and BofA also optimistic with 6500 and 6666 forecast respectively on the back of US economic growth and corporate earnings strength. DB and FundStrat are even more aggressive with 7000 projection on solid demand-supply backdrop for US equities. Citi found that risk flows are particularly evident with SPX positioning assymetric and one-sided long whilst NASDAQ short positioning has marginally declined below longer-term averages. Also, JPM Dimon stands out from Wall Street expressing concerns about elevated valuations in US stocks citing deficit spending, inflation and geopolitical uncertainties. Given his track record though, he cannot be trusted as he tends to talk his book and act contrary to his recommendations.

US producer prices also picked up Oct 2024 lifted by higher services cost like portfolio management and airline fares, another sign that progress toward lower inflation is stalling. Interestingly, US industrial production actually been heading higher during the same period. On 15/11, US retail sales increased slightly more than expected in Oct 2024 as household boosted purchases of motor vehicles and electronic good. Big picture wise, not a huge difference but its shows investors are very sensitive to the consumer this part of the cycle.

On 16/11, China XJP reiterated to Biden that Taiwan, democracy, development are China’s red lines. However, a few days later he vowed to work with the incoming Trump adminstration. He also said that unilateralism and protectionism needs to be rejected in favor of economic globalisation in the same month at APEC summit prior to Trump’s return. EU Commission also weighed in that US protectionism would be extremely harmful to US and Europe. US Trump has floated the idea of a 10% tariff on all good imported in the USA. Irish corporate tax receipts, mainly paid by US firms have risen 7x over the last decade due to these companies moving intellectual property assets to Ireland. These tax receipts are at risk due to Trump’s pledges to slash corporate tax, incentivize production back ot the US and impose tariffs given US heavy reliance on a small cluster of US tech and pharma MNCs. Another complication is that IP assets are easy to move like in 2015 as it doesn’t involve building a factory or any movement of goods.

On 07/11, Citi economists predict that a 60% tariff on Chinese goods entering the US market would reduce China’s GDP grwoth by 2.% in an extreme scenario. However, they also added the 60% tariff is more likely to be a bargaining chip than a real risk. A more realistic scenario would be an additional 15% increase which would dent China’s GDP growth by 0.5 – 1.5%. Also, the PBoC might defend the $/CNH to manage market expectations and bilateral trade imbalances whilst NPCSC is unlikely be to effected by US election outcome. So far, China has provided fiscal support well below market expectations opting for liquidity injection and rate cuts in 2024 and CEWC unwilling to provide hard numerical targets for 2025. However, some analyst expect that might change as China ramps up economic support to counter Trump’s tarriff threats.

Chinese home prices have actually fallen at the slowest pace in 17M in nov with the crisis-hit property market showing signs of stabilising in major cities amid government efforts to revive the real estate sector. Also, China now plans record budget deficit of 4% GDP in 2025 from initial target 3% in 2024 which underlines policy support momentum. On 03/01, Chinese govt workers were given a surprise wage increase which amounts to one-time $12 – 20B for 4M pax. The last time, such stimulus happened was in 2015 when China raise pay for local officials by +30% to combat corruption and riase consumer spending power. China also seeking to bolster ports and aviation hubs in Western regions such as Chengdu, Chongqing, Kunming, Xian and Urumqi. This will also revitalize rural areas, expaned poverty alleviation and strengthen energy resources.

On 11/12, Alibaba group said

it recorded robust growth and record number of shoppers over 2024’s Singles’

Day sales period. JD.com which didn’t disclose the same did however report more

than 20% y/y growth which indicates the Chinese consumer remains strong. Major

stimulus anouncement from China’s central government which boosted Chinese

stocks markets were not a major factor according to WPIC Jacob Cooke.

Interstingly, Jacob expectes 2025’s mid-year sales festivals to be even more

impressive. Shan Yin, a 23-year old student from Hangzhou bought gaming

products League of Legends and Noragami/ Banana Fish collectibles totalling CNY

3200 to cope with the stress of her engineering studies.

China’s property investment fell at a faster pace from Jan to Oct 2024 but sales narrowed the slump showing policy stimulus is starting to inject some life into the crisis-hit sector, although robust recovery might take some time. In terms of the broad trend, we can see some bottoming action since 2H22 around -11% level. Most recently, China unveiled tax incentives for home and land deals to boost demand and alleviate financial pressure on developers.

TikTok parent Bytedance’s

valuation hit $300B after it recently approached investors about a share

buyback program. A law signed by outgoing President Biden on 04/24 gives

Bytedance until 19th Jan to sell TikTok or face a ban. The White

House wants to see Chinese-based ownership ended national security grounds but

not a ban on TikTok.

US yield curve has steepened considerably with 3M T-bill yield dropping 5% whilst 30Y US Treasury bond yield rising by 7.4%. This has happened due to the resilience of the US economy and Trump’s perceived pro-inflation policies. Also, US treasury yields eased on 24/11 when former hedge fund manager Scott Bessent was nominated to US Treasury Secretary position given the perception that he will be more fiscally disciplined than investors had feared earlier. On the other side, massive moves in China with 2Y CGB and 10Y CGB plunging 8.9% and 20.2% whilst Japan has moved the other way with 2Y JGB rallying 39% with more muted move in 10Y JGB +20%.

Broad commodities haven’t moved much with for crude oil jumping 8.8% and NG futures surging +39.5%. BTC/$ had moved higher by +15% hoving aroud $100k handle. Enormous catch-up move with XRP/$ going parabolic at +389% from $0.64 to $2.36 in less than 2M time horizon. BNB/$ creeping up +18% with DOGE/$ climbing +13%. SHIB/$ hardly moved at +1.9% which is nothing in the super sonic crypto land.

On 26/11, BofA has highlighted that Trump policies would lead to higher growth, higher rates and a stronger USD which would limit investors’ appetite to increase gold purchases. Bitcoin hit above $81k from on Trump election victory on 11/10 and now trading comfortably above $100k handle. On 11/12, DOGE surged 25% on speculation that Elon Musk would secure a position in the Trump position which was a rumor which has since become fact signalling insider trading. Updated Fibo projections and found that BTC/$ can hit $143 – 148k which is possible as the token remains bid due to Trump strategic reserves talk. ETH/$ key levels are $4445 and $5828 – 5907 and possibly even $7367. BNB/$ also suggested to be targeting $813 – 830 and $943 – 946.

Congress also likely to adopt legislation govering crypto currencies during Trump’s term according to former Wall Street regulator and potential political appointee Jay Clayton. JPM anticipates significant changes in crypto markets due to Trump with FIT21 and Clarity for Payments Stablecoins Act of 2023 to be expedited. The SEC may shift from enforcement-driven actions to a more collaborative approach particularl for Coinbase which would reduce barriers for Robinhood and Uniswap. SAB 121 which limit’s banks ability to deal with crypto assets could also be reversed. Spot ETF for XRP and Solana might be benefit from the optimism whilst clearer regulations could attrached VC, IPO and M&A activity. Intriguingly, JPM doesn’t see the BITCOIN Act establising BTC as a US strategic reverse asset as a high probablity event.

If the Bitcoin Strategic

Reserve does follow through, it would be releases at times of crisis or supply

disruptions. This is similar to Canada’s strategic reserve of maple syrup and

China’s reserve of metals, grains and pork products. The reserve could include

BTC seized by the US govt from the criminal sector circa 20k tokens worth $21B

today. Otherwise, debt could be issued or gold reseves depleted to add to the

bitcoin stockpile. MSTR targets $2B capital raise to buy BTC in 1Q25 as

announced by Michael Saylor on 04/01. On 03/01, deVere Group Nigel Green also

predicts that US will acquire 3000 – 400k BTC in 2025 for the reserve.